With the global narrative often saturated with pessimism during economic recessions, it’s essential to remember that every challenge presents its own set of opportunities. From concerns about job security to fluctuating pension pots, economic downturns can be daunting. However, history offers insights into steps individuals can take to navigate these times productively.

-

Capitalizing on Higher Interest Rates

In the early phases of an economic downturn, it’s not uncommon to see interest rates rise. For instance, from December 2021 to August 2023, the Bank of England steadily raised interest rates from a meagre 0.1% to an impressive 5.25%.

For savers, such times can be ripe with opportunities. If you’re contemplating bolstering your savings, the current climate may be favourable. Delve into savings options like fixed-term deposits and money market accounts. Often, these offer more attractive interest rates compared to the standard easy-access savings accounts, making it crucial to shop around and discern the best options.

-

Acquire Assets at Reduced Prices

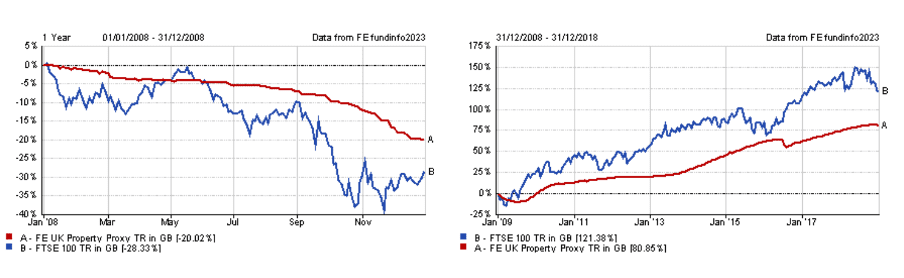

History stands testament to the fact that asset prices, whether they be property, stocks, or other investments, frequently plummet during economic recessions. To illustrate, in the 2008 recession, the FTSE 100 Index diminished by nearly 30%, while the average UK house prices fell by around 20%. Fast forward a decade to 2018, and the FTSE 100 index ballooned by over 120%, with UK property prices augmenting by 80% from their lowest post-crisis point. (Source: FE Analytics, FTSE 100 & FE UK Property Proxy Total Return)

Such downturns have seen astute investors snap up assets that later witnessed substantial value appreciation during the recovery. Along with pinpointing top-tier companies whose stocks might have dipped more than they should have, those who consistently invest throughout a recession can harness the benefits of “Pound Cost Averaging”. This strategy ensures a lower overall cost per share, offering potential gains during the subsequent recovery. Additionally, falling share prices can be a boon for investors looking for income from dividends, especially when focusing on robust companies that can maintain profitability even during recessions.

-

Gearing Up for the Post-Recession Surge

Typically, while the onset of a recession sees a spike in interest rates, the tail-end witnesses a reversal, with policymakers trimming rates to breathe life back into a flagging economy. As savings rates begin to diminish in appeal, reduced mortgage rates can beckon homebuyers, especially those who’ve prudently saved and invested during the downturn.

Every recession eventually gives way to economic expansion. By astutely positioning oneself, diversifying portfolios, and employing strategies like Pound Cost Averaging, one can be poised for significant gains during the economy’s upswing.

Amid the challenges, it’s heartening to recall that even during bleak economic times, innovations and opportunities abound. Consider how companies like Airbnb and Uber, born during the 2008 Great Financial Crisis, have since soared to immense success.

For personalised financial advice tailored to your situation, our team at Fusion Financial is just a call away.

The value of units can fall as well as rise, and you may not get back all of your original investment.

Approved by In Partnership, FRN 192638, 25/10/2023.

**Disclaimer:** This article is intended for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial professional before making any financial decisions. Past performance does not guarantee future results.